The Business Platinum Card from American Express overview

The Business Platinum Card® from American Express is likely one of the finest enterprise rewards playing cards round, because of its giant welcome bonus and the sheer variety of value-added perks. While it requires some work to take full benefit of them, the trouble can repay with financial savings of a whole lot and even 1000’s of {dollars} per yr. Card score*: ⭐⭐⭐⭐

* Card score relies on the opinion of TPG’s editors and isn’t influenced by the card issuer.

With premium playing cards within the mainstream nowadays, many individuals are comfy paying annual charges of over $400. The Business Platinum Card from American Express stands out above even that, although, with a $695 annual payment (see charges and charges) — though its annual assertion credit and advantages go above and past to offset that yearly value.

Between its excessive annual payment and a handful of business-focused perks, this card actually will not be appropriate for each small enterprise — particularly ones that do not log main journey bills or ones with major spending areas extra according to the bonus classes supplied by different enterprise playing cards. Still, it has some useful perks, making it a powerful selection for a lot of companies.

We suggest candidates have a credit score rating of 670 or above to extend their probabilities of getting accepted.

Let’s dive into the card details so you may determine if it is a good match for your online business.

Related: How to get a enterprise credit score card

Amex Business Platinum execs and cons

| Pros | Cons |

|---|---|

|

|

*Enrollment required for choose advantages. Terms apply

Amex Business Platinum welcome supply

Right now, new Amex Business Platinum candidates can earn:

Daily Newsletter

Reward your inbox with the TPG Daily e-newsletter

Join over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

- 150,000 factors after spending $20,000 on eligible purchases within the first three months of card membership; plus

- A $500 assertion credit score after spending $2,500 on qualifying flights booked straight with airways or by means of American Express Travel inside the first three months of card membership.

To earn the $500 assertion credit score, you should buy flights throughout any variety of airways (it does not need to be only one). The bookings might be made both straight with the airline or by means of Amex Travel. Note that you have to meet the $2,500 minimal spending requirement for airfare purchases inside three months of being accepted for the card.

Our April 2025 valuations peg the Membership Rewards factors this card earns at 2 cents apiece. So, if you happen to can handle the excessive spending requirement on this tiered supply, you will obtain as much as $3,500 in worth. This beats the very best welcome supply we now have seen on this card, because of the addition of the assertion credit score for airfare purchases.

While $20,000 in three months may not be laborious for companies with a number of money circulation, in case your enterprise is smaller, you possibly can think about prepaying as many bills as you may afford throughout your first three months to assist earn your welcome supply.

As a cardmember, you will get extra worth from the $500 assertion credit score by stacking it with an Amex Offer. After making use of for the card and being accepted, search for Amex Offers offering money again or bonus Membership Rewards factors for airfare purchases.

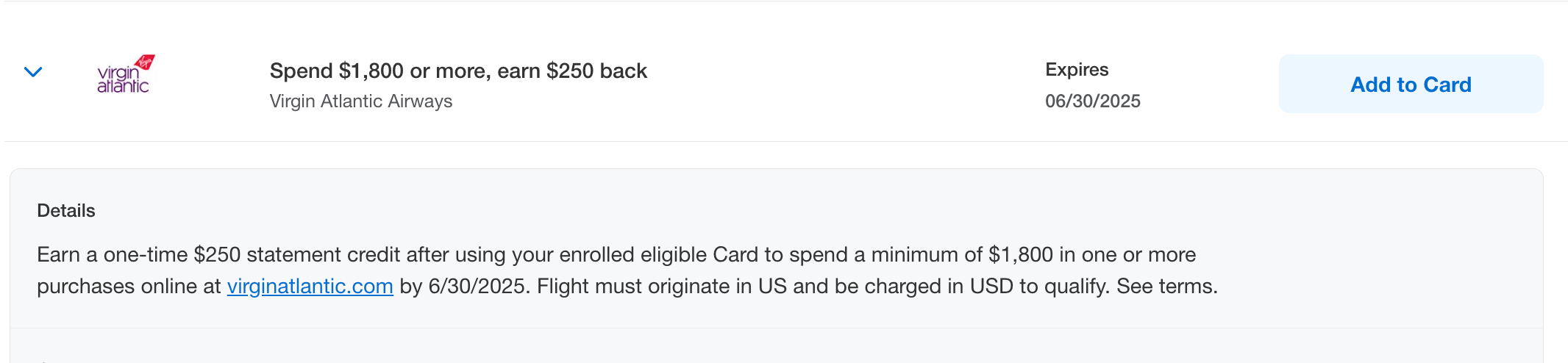

For instance, an Amex Offer obtainable to TPG credit score card author Danyal Ahmed is a $250 assertion credit score after spending $1,800 or extra with Virgin Atlantic. By stacking this with the welcome supply, a cardmember might stand up to $750 in assertion credit score on Virgin Atlantic flights.

On the opposite hand, if this sort of spending is out of your league, one other enterprise card with a decrease bonus threshold, a smaller annual payment and extra focused incomes classes may be a greater match for you in the long term.

Related: How to attain the Amex Business Platinum’s spending requirement to earn 150,000 factors

Amex Business Platinum advantages

Amex’s bevy of assertion credit, simply totaling over $1,500 in annual advantages, might help cardmembers doubtlessly offset the preliminary shock of that top annual payment. Here’s an in depth have a look at all of them (enrollment is required for choose advantages, phrases apply):

| Statement credit score | Annual quantity | How it really works |

|---|---|---|

| Dell† | Up to $400 per calendar yr | Statement credit score on U.S. Dell purchases as much as $200 semiannually |

| Indeed | Up to $360 per calendar yr | Statement credit score on Indeed hiring and recruiting services and products to submit open positions and discover expertise, as much as $90 per quarter |

| Adobe† | Up to $150 per calendar yr | Statement credit score on choose annual purchases (topic to auto-renewal), together with Adobe Creative Cloud and Acrobat Pro DC |

| Hilton | Up to $200 per calendar yr | Statement credit score as much as $50 per quarter on eligible purchases made straight with a property within the Hilton portfolio. Hilton for Business program membership is required. |

| Wireless phone companies | Up to $120 per calendar yr | Statement credit for purchases made straight from any U.S. wi-fi phone supplier, as much as $10 monthly |

| Clear Plus | Up to $199 per calendar yr | Statement credit score towards an annual Clear Plus membership for expedited airport safety (topic to auto-renewal) |

| Airline payment | Up to $200 per calendar yr | Annual airline payment credit score of as much as $200 on prices by the airline you choose every calendar yr |

| Global Entry or TSA PreCheck | Up to $120 | Statement credit score for Global Entry ($120) or TSA PreCheck (as much as $85) each 4 years (4.5 years for PreCheck) |

†The Dell and Adobe credit will change on July 1, turning into extra beneficiant — however requiring extra spending.

Alongside the plethora of assertion credit it’s possible you’ll (or might not) be capable to use, the Amex Business Platinum shines by means of with its different journey perks.

Aside from entry to Amex’s Centurion Lounges, your card will open the door to the in depth American Express Global Lounge Collection (entry is proscribed to eligible cardmembers). It is comprised of greater than 1,700 lounges worldwide, together with Delta Sky Clubs which you can enter when you’ve gotten an eligible same-day flight on that airline, Priority Pass lounge entry (enrollment required; excluding restaurant areas), Escape Lounges and Lufthansa Lounges when you’ve gotten a same-day flight on that airline.

However, it is price noting that you just’re restricted to 10 complete Delta Sky Club visits per yr — until you spend $75,000 in a calendar yr to unlock limitless entry.

As for advantages that come in useful when you attain your vacation spot, this card permits you to register for complimentary Gold standing with Hilton Honors and Marriott Bonvoy, which give increased earnings and elevated advantages throughout stays with these two manufacturers.

Cardmembers additionally take pleasure in complimentary elite automobile rental standing with a number of applications, together with Avis Preferred, Hertz Gold Plus Rewards and National Emerald Club. (Enrollment required for these advantages.)

As you may think, the Amex Business Platinum Card can also be nice for enterprise purchases. It options prolonged guarantee safety‡ that prolongs eligible U.S. producer warranties of 5 years or much less by a further yr, saving enterprise homeowners money and time if one thing occurs to an merchandise they purchase.

Additionally, the card’s buy safety covers unintended harm or theft for as much as 90 days after buy, as much as $10,000 per coated buy and $50,000 per cardmember account per calendar yr, so it is an ideal selection for costly gadgets.‡

Aside from these two particular advantages, the card’s different notable perks embrace:

- Cellphone safety, for a most of $800 per declare with a restrict of two accepted claims per 12-month interval. Coverage for a stolen or broken eligible cellphone is topic to the phrases, circumstances, exclusions and limits of legal responsibility of this profit.§

- Access to the Cruise Privileges Program and the International Airline Program

- A 35% rebate while you use Pay with Points to cowl a first- or business-class ticket on any airline or an financial system ticket on one airline of your selection (as much as 1 million factors again per calendar yr)

‡Eligibility and profit degree varies by card. Terms, circumstances and limitations Apply. Please go to americanexpress.com/benefitsguide for extra details. Underwritten by AMEX Assurance Company.

§Eligibility and profit degree varies by card. Terms, circumstances and limitations Apply. Please go to americanexpress.com/benefitsguide for extra details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Related: Is the Amex Business Platinum definitely worth the annual payment?

Earning factors on the Amex Business Platinum

Amex Business Platinum cardholders will earn 1.5 Membership Rewards factors per greenback spent on as much as $2 million in eligible purchases within the U.S. per calendar yr within the following classes:

- Eligible purchases of $5,000 or extra

- U.S. cloud service suppliers

- U.S. development supplies and {hardware} provides

- U.S. digital items retailers

- U.S. transport suppliers

- U.S. software program

Cardmembers earn 5 factors per greenback spent on airfare and pay as you go resort purchases with American Express Travel (together with Amex Fine Hotels + Resorts).

All different purchases earn 1 level per greenback spent.

Related: Everything you must find out about Amex Membership Rewards

Redeeming factors on the Amex Business Platinum

We suggest transferring your Membership Rewards factors to any of Amex’s resort and airline companions for max worth.

You may also redeem your factors for service provider present playing cards or to cowl prices in your invoice. However, these choices considerably devalue your rewards to 1 cent per level or much less, so we do not suggest utilizing your factors this fashion.

The best redemption possibility that also presents first rate worth is American Express Travel’s Pay with Points characteristic, which lets you obtain a 35% bonus while you use factors towards first- and business-class flights on any airline, in addition to economy-class flights on a specific airline. This boosts your redemption worth for these purchases from 1 cent to 1.54 cents per level.

Just word that the 35% rebate is capped at 1 million factors again per calendar yr, and you have to have the total variety of factors for the usual redemption in your account on the time of reserving. You’ll then obtain the rebate inside two billing cycles.

Transferring factors on the Amex Business Platinum

You can unlock much more worth out of your earnings by transferring your Membership Rewards factors to any of Amex’s 21 airline or resort companions. Most transfers happen at a ratio of 1:1 and are processed immediately.

Going this route might take a little bit of analysis, however somewhat work might help improve the worth of your factors considerably above the TPG valuation.

You’ll additionally need to look ahead to Amex’s common switch bonuses, which may additional improve the worth of your factors.

TPG bank cards author Chris Nelson ceaselessly receives outsize worth by using Amex’s beneficiant switch bonuses to Avianca LifeMiles, to e-book lie-flat seats on Star Alliance companions, akin to United Polaris business-class flights to Europe.

Related: The finest methods to make use of Amex Membership Rewards factors

Which playing cards compete with the Amex Business Platinum?

If you are feeling that your online business may not be capable to get the total worth out of the Business Platinum Card, you would possibly need to think about different choices:

For extra choices, try our full listing of the very best enterprise bank cards.

Read extra: Ink Business Preferred vs. Amex Business Platinum: Practicality vs. luxurious

Bottom line

The Amex Business Platinum Card is a superb selection for enterprise vacationers with bills in bonus classes and those who supply assertion credit. While it may not be price it for all enterprise homeowners, its journey perks are unbeatable.

With a plethora of journey advantages, the Amex Business Platinum is a must have card for enterprise homeowners trying to elevate their travels.

Apply right here: Amex Business Platinum

For charges and charges of the Amex Business Platinum, click on right here.

For charges and charges of the Amex Business Gold, click on right here.