Citi is a TPG promoting associate.

For many vacationers, airport lounge entry is essential because it permits an area the place you may both calm down earlier than a journey or be productive and get work carried out.

This is the place American Admirals Club lounges are available — over 50 of them exist all around the world, and you may get entry by buying a daypass for a price or utilizing AAdvantage miles.

However, one of the best ways to entry Admirals Clubs is thru one particular credit card: the Citi® / AAdvantage® Executive World Elite Mastercard® (see charges and costs) — which is the one card that may get you into Admirals Clubs. While it does include a $595 annual price, the unique lounge entry may make it price including to your pockets.

In truth, managing editor Matt Moffitt’s foremost purpose for opening the Citi AAdvantage Executive card was for Admirals Club entry.

Related studying: The final information to Admirals Club entry

Why this card is a winner

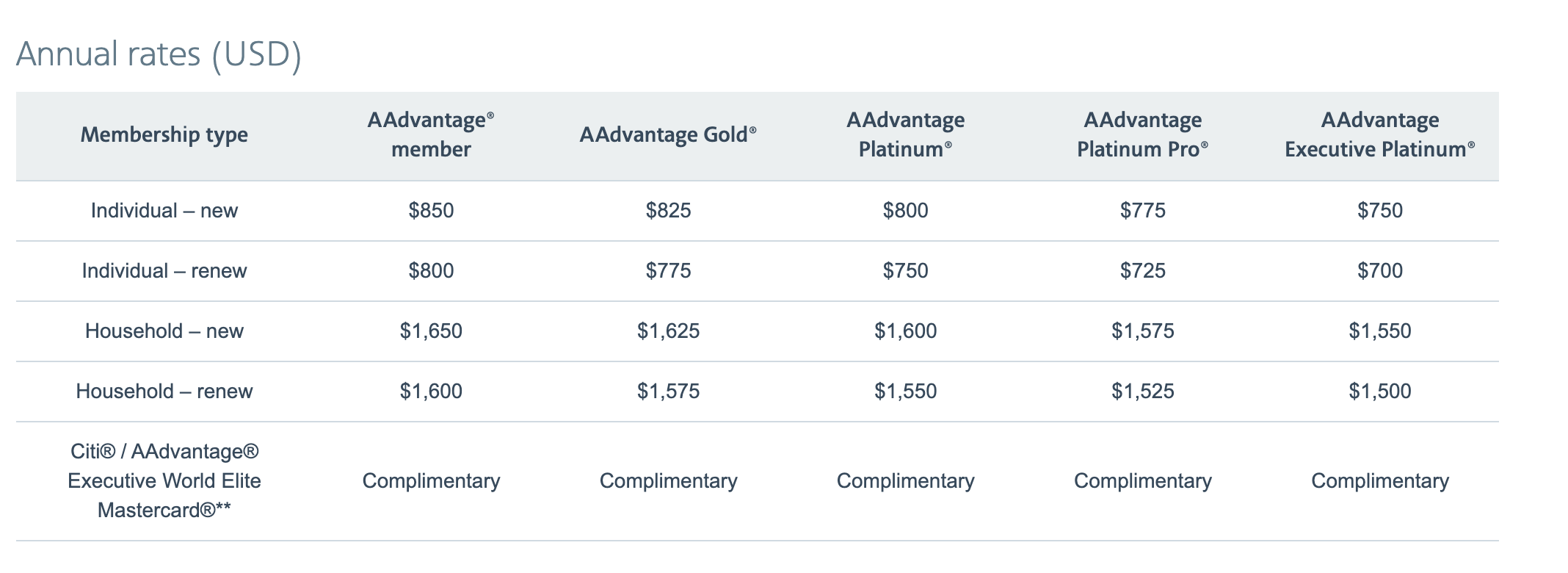

If you may’t get entry to an Admiral Club from elite standing or the category of service you are flying, one choice is to buy a membership. Here is annual pricing damaged down by AAdvantage stage:

Related studying: Full overview of the Citi/AAdvantage Executive World Elite Mastercard

1. Cheaper than paying for an Admirals Club membership

However, one of the best ways to ensure entry into Admirals Clubs is to have the Citi AAdvantage Executive card. You’d really lower your expenses by having the card versus paying for any of the membership choices.

Daily Newsletter

Reward your inbox with the TPG Daily e-newsletter

Join over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

For occasion, say you have been contemplating buying an Admirals Club membership as a basic AAdvantage member (no elite standing). Instead of paying $850 for entry per yr, you would be higher off making use of for the Citi Executive card and paying the $595 annual price per yr, plus getting different credit card-specific perks.

The card at present affords a sign-up bonus of 70,000 AAdvantage miles after you spend $7,000 in purchases inside the first three months of account opening, price $1,106, primarily based on TPG’s most up-to-date valuations.

Related studying: American Airlines joins Delta and United in extending elite standing and extra

2. Authorized consumer entry

The Citi AAdvantage Executive World Elite Mastercard means that you can add as much as 3 licensed customers for $175, then $175 for every extra licensed consumer. Authorized customers may also entry Admirals Clubs.

This applies whether or not the first cardholder is flying with that particular person or not, a unbelievable perk that’s notably totally different from comparable premium playing cards supplied by different U.S. carriers.

Note that whereas main cardholders have entry to all Admirals Clubs (over 50 worldwide) and associate lounges (about 60 worldwide), licensed customers solely get entry to American Admirals Clubs. However, each the first cardholder and every licensed consumer can deliver fast members of the family or as much as two touring visitors into the lounge.

Related studying: The greatest credit playing cards for airport lounge entry

3. Other Citi Executive card perks

With this Citi card, you may additionally earn 10 miles per greenback on eligible inns booked by aa.com/inns and eligible automobile leases booked by aa.com/automobiles.

In addition, cardholders earn 4 miles per greenback on eligible American Airlines purchases, as much as $120 in assertion credit for eligible Grubhub purchases (as much as $10 monthly) and as much as $120 assertion credit on Avis or Budget automobile leases every calendar yr.

The card comes with Group 4 precedence boarding and your first checked bag free on home American Airlines itineraries for you and as much as eight companions on the identical reservation.

In addition, like a variety of different premium playing cards, this one additionally affords a Global Entry or TSA PreCheck utility price credit. You’ll stand up to a $100 assertion credit as soon as each 4 years to reimburse your utility price.

Related studying: Battle of the premium journey rewards playing cards: Which is one of the best?

Admirals Club restrictions

American Airlines requires a same-day boarding cross for American or one in every of its companions to entry an Admirals Club lounge earlier than or after a flight. While this transfer is alleged to cut back overcrowding within the lounges, it is undeniably a devaluation for elite members and paying clients alike.

This new rule was instituted no matter the way you earned entry — whether or not by a credit card or paid outright for an annual membership. That means you are not deprived with this Citi AAdvantage Executive card over different membership members.

Related studying: AA, Delta and United lounges have restricted entry to clients flying with them: Here’s what to do

Bottom line

The Citi AAdvantage Executive card is exclusive in which you can unfold the advantage of the annual price with family and friends in a means which you can’t do with simply an Admirals Club membership by including licensed customers and paying a reasonable price.

As a frequent AA or Oneworld alliance flyer, that is one of the best card for Admirals Club entry along with many different perks akin to assertion credit, Loyalty Point bonuses, and first rate incomes charges.

Apply right here: Citi / AAdvantage Executive World Elite Mastercard