As you could have seen, Chase not too long ago advised us that the finest Chase Sapphire Preferred® Card (see charges and charges) offer we have seen this 12 months is ending on May 15 at 9 a.m. EDT.

With 100,000 Ultimate Rewards bonus factors on the line — and no approach to know if as soon as the offer is gone whether or not Chase will take one other four-year break (or longer?!) earlier than they roll out an offer this large — we do not want anybody to unintentionally mess this chance up.

Offer alert: Earn 100,000 bonus Chase Ultimate Rewards Points after spending $5,000 inside three months from account opening with this limited-time offer on the Chase Sapphire Preferred earlier than the offer ends on May 15.

Based on the many emails and feedback on our social posts about this uncommon and helpful 100,000-point offer, we have picked up on just a few themes the place would-be-Sapphire Preferred cardholders have some nice questions … or, in some circumstances, unlucky mistake tales.

While there are some errors we sadly cannot erase, we will hopefully unfold the phrase about these you can avoid to improve your approval odds.

Related: Is the limited-time 100,000-point Chase Sapphire Preferred offer actually one in all the finest offers ever?

Applying for a Chase Sapphire Preferred with a Chase Sapphire Reserve open

Unfortunately, Chase is fairly darn strict that you can solely have one ‘taste’ of a Sapphire card open at a time.

That means if you are at present a main cardholder with an open Chase Sapphire Reserve® (see charges and charges), you would not be eligible for a Chase Sapphire Preferred. This additionally applies to those that could have downgraded their card to a no-annual-fee Sapphire card, too.

Note that calling Chase to change your product from Chase Sapphire Reserve to Preferred won’t set off eligibility for the bonus. You have to apply from scratch for the Chase Sapphire Preferred and get authorized to be thought-about for the offer with the 100,000 bonus factors.

Daily Newsletter

Reward your inbox with the TPG Daily publication

Join over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Pro tip: Downgrade to a card in the Chase Freedom household if you do not want to totally shut your account and want to get a Sapphire Preferred or Reserve once more in some unspecified time in the future in the future. Also, downgrading does not have an effect on your credit score rating the identical approach closing an account does.

The data for the Chase Sapphire has been collected independently by The Points Guy. The card particulars on this web page haven’t been reviewed or supplied by the card issuer.

Related: Who’s eligible for the Chase Sapphire Preferred’s 100,000-point bonus?

Thinking you aren’t eligible as a result of you’re a Chase Sapphire licensed person

While you can solely have one Sapphire card open as the main account holder, being a licensed person on a Chase Sapphire Reserve or Preferred shouldn’t in any other case cease you from opening an account (with the bonus!) and getting the card underneath your personal title.

Not ready 48 months from when you final earned a Sapphire welcome bonus

The phrases state that “previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months” usually are not eligible for the welcome bonus. And notice that it says it’s 48 months from receiving a brand new cardmember bonus, not 48 months from opening a Sapphire account.

First, if you aren’t certain when you had a Sapphire card in the previous, you can take a look at your credit score report to see when you opened it. But that is not the date you ought to use for the 48-month clock.

On your on-line Chase account, you can see up to seven years of statements. Once you’ve narrowed down when you opened the card, check out your statements round that time-frame to verify when your bonus really hit.

Keep in thoughts that if you suppose you took shut to the full three months to earn the bonus, the bonus factors could not have come by for just a few months after the reality.

Once you’ve discovered your magic month, be certain you’re 48 months eliminated.

This additionally signifies that if you received a Sapphire Preferred the final time it had a 100,000-point welcome bonus in the summer time of 2021, it virtually definitely has not been 48 months since you earned that welcome bonus.

The notorious Chase 5/24 rule

Chase has an unwritten however very actual rule that you cannot have opened greater than 5 credit score accounts throughout all banks inside the final 24 months and get a sixth (or extra) new account from them. Some accounts — corresponding to these opened by your small enterprise — could not depend in opposition to this whole, however in any other case, this can be a fairly laborious and quick rule.

If you are denied for too many current new accounts and suppose you are underneath 5/24, you can name Chase and see if they will flip the no to a sure, particularly if you have some accounts the place you’ve been added as a licensed person versus the main account holder.

Related: Your information to calling a bank card reconsideration line

Not having a deep sufficient credit score historical past

While a credit score rating in the 700s is believed needed to get authorized for the Chase Sapphire Preferred, it is doable that the rating alone does not make opening the card a slam-dunk.

We have heard from various TPG readers who weren’t authorized for this offer regardless of stating they’ve “high credit scores.” What this will typically imply is that the applicant does not have a demonstrated historical past on their very own credit score report of managing a mixture of accounts or a sure variety of revolving card accounts.

Whether it’s as a result of you are younger and beginning out, or have simply had accounts primarily in a accomplice’s title whereas you’ve been a licensed person, this is usually a hurdle to getting some actually good rewards playing cards. There’s no in a single day repair for a denial for that reason, however we suggest build up your credit score with a card or two in your title so you’ll be prepared in the future.

Related: The 6 finest starter playing cards for constructing your credit score

Miscalculating spending for the welcome bonus

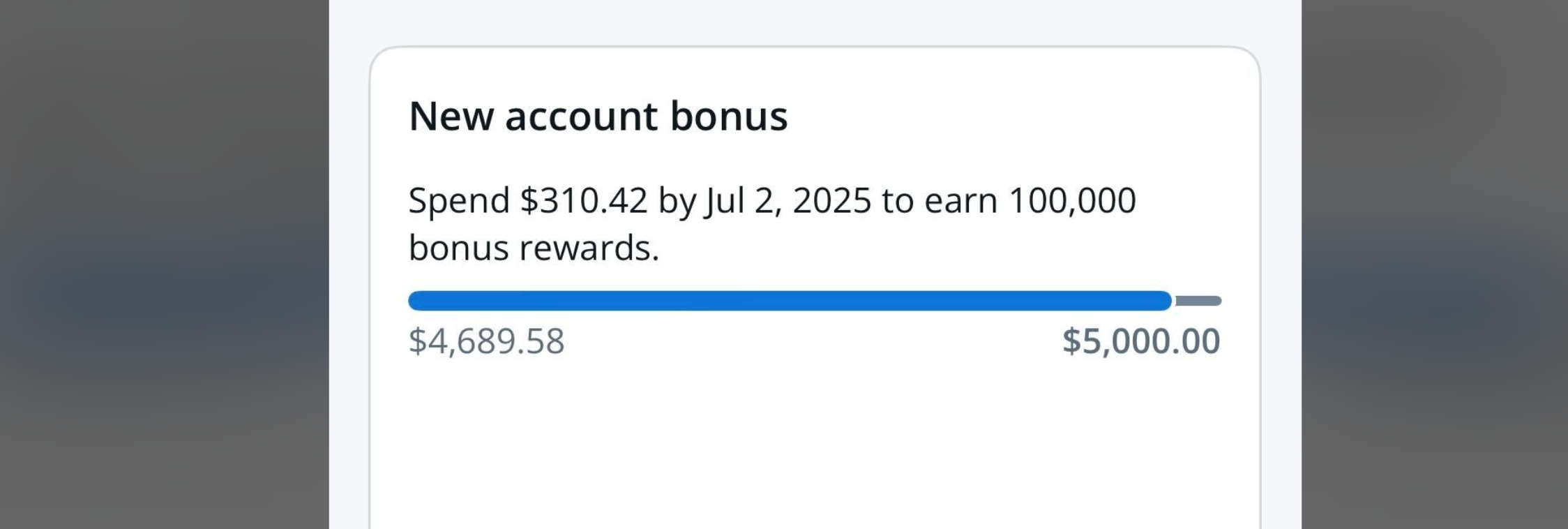

To earn the 100,000 bonus factors, you want to spend $5,000 on the card in eligible purchases in the first three months. Given how helpful these 100,000 factors are, you don’t want to mess this one up.

First, know that the $95 annual price doesn’t depend towards that spending. Second, I virtually tousled incomes a welcome bonus earlier than, as I paid for some issues with Venmo connected to the card, which didn’t depend as a “cash equivalent”.

You can monitor your progress by going to the spending tracker in the “benefits and travel” part of your Chase on-line account, choosing rewards, choosing Chase Sapphire Preferred and scrolling down.

In the Chase app, you ought to have the ability to choose Chase Sapphire Preferred after which scroll down.

I additionally suggest in opposition to ready till the very finish of the three months to cross that threshold, as purchases want to put up to the account in these three months to depend.

So if you ordered one thing on-line with solely a day or two to go, however then it did not cost your card till the order shipped 4 or 5 days later, you’d be left with out the 100,000 bonus factors if you wanted that buy to get you over the $5,000 threshold.

If assembly that spending requirement would require some effort, this is a refresher on on a regular basis issues you can cost to bank cards to assist you meet it (and past).

Pro tip: Car and householders insurance coverage are an enormous assist in direction of spending bonuses in my home.

Related: 9 issues you did not know you might pay for with a bank card

Forgetting to unlock your credit score report

When you apply, Chase will clearly pull your credit score report earlier than deciding whether or not to subject you a brand new account. So, if you typically freeze your credit score report, you will want to ensure you have unlocked it for Chase to have the ability to entry it.

Some anecdotal stories counsel Chase typically appears at the credit score bureau Experian — although it might fluctuate. Regardless, whereas there could also be options if you overlook to unlock your credit score report earlier than making use of, it is a lot simpler to keep in mind to try this step.

Missing out on the finest offer in years

Last however not least … do not make the mistake of ready too lengthy and lacking out on the finest offer on this card in virtually 4 years. Chase has stated it’s ending on May 15 at 9 a.m. EDT, so now’s the time to act if you do not want to miss out.

I keep in mind in 2021, when this offer was final round, some people waited till the final minute to apply. Then life occurred, and so they finally missed out.

Right after it ended, I received many emails and questions on when it might come again or if there was something they might do, and the reply is as soon as it is over, it is over.

If you want it, suppose you’re eligible and may hit the spending requirement, you’ve received till early in the morning on May 15.

Bottom Line

These are the most typical errors we have come throughout from these wanting to apply to the Chase Sapphire Preferred and earn the 100,000 bonus.

It comes down to this: Check when you final obtained a welcome bonus on a Sapphire card, downgrade if you at present have a Sapphire product, ensure you’re underneath 5/24, unfreeze your credit score report, spend accordingly and do not miss out on the finest offer this 12 months.

And keep in mind, the offer is ending very quickly, so do not delay on making use of.

Apply right here: Chase Sapphire Preferred