Having your credit card application denied can come as a shock. It’s essential to know that there are just a few elements that go into the issuer’s determination to say no.

Although it may be discouraging, do not forget that it will probably occur to anybody. Even some TPGers have been rejected for no less than one card.

Before making use of once more, it is best to grasp the elements behind a denial. Danyal Ahmed, a credit playing cards author at TPG, was denied as soon as, and it solely motivated him to determine why and take a look at once more after addressing areas that required his consideration.

Here are some causes your credit card application was denied and how one can get accepted subsequent time.

What to know earlier than making use of for a credit card

Issuers evaluate credit card functions holistically. That signifies that they take a look at a wide range of elements, and every issuer could consider the identical applicant in another way.

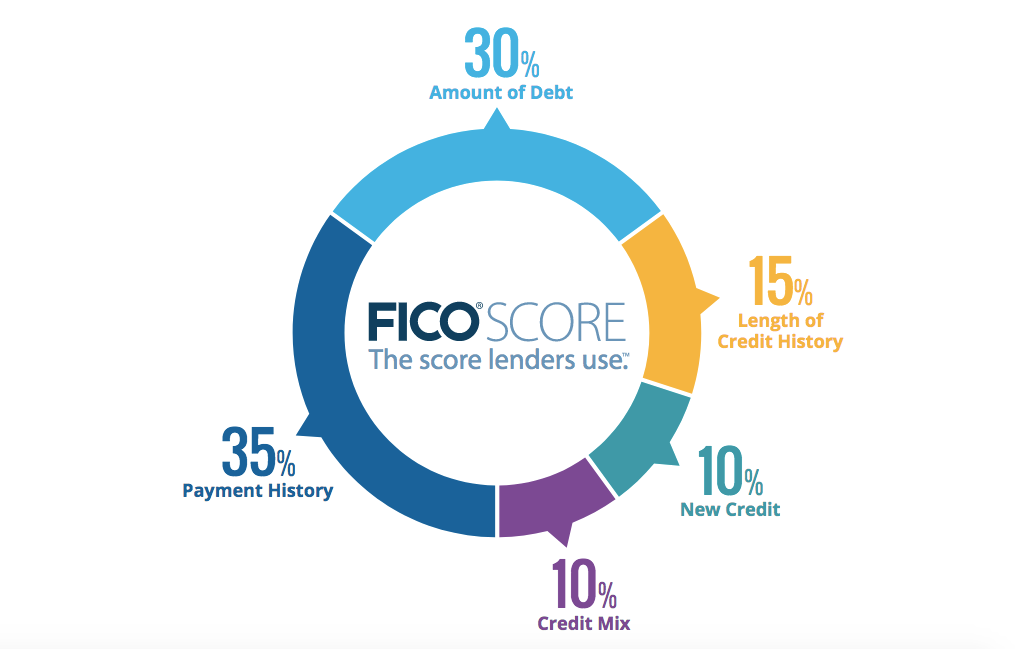

Applicants ought to purpose to have each good credit and an extended line of credit historical past. One of a very powerful elements is your fee historical past, which determines 35% of your total rating.

After submitting a credit card application, you may sometimes discover out that you simply had been accepted on the spot. However, if you happen to’re denied, it is best to obtain a letter inside seven to 10 enterprise days of your application submission date.

If you are conversant in your private credit historical past, you might be able to work out why you weren’t accepted earlier than receiving your letter with one of many explanations beneath.

Credit report errors

The first step to take earlier than making use of for a credit card is to take a look at your credit report. Check the variety of accounts in your title and guarantee they’re in good standing. If you discover a mortgage or credit line that you have not consented to, you could be a sufferer of identification theft.

Daily Newsletter

Reward your inbox with the TPG Daily e-newsletter

Join over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Be looking out for inaccurate private data and reporting errors which can be affecting your rating. You can examine your credit report without cost at AnnualCreditReport.com and dispute any errors you discover to forestall future credit rejections.

Related: Credit card fraud vs. identification theft — how one can know the distinction

Insufficient credit historical past

Having a brief or nonexistent credit historical past could make you ineligible for sure credit playing cards. Your credit report ought to include no less than one energetic account to generate a FICO credit rating. With no credit historical past, collectors can not gauge your creditworthiness and the probability that you’ll repay your stability.

A credit card is not the one account sort that may depend towards your credit historical past. If you will have a automotive fee or pupil loans, these can depend towards constructing your credit historical past, too.

Credit card newbies ought to think about different choices comparable to turning into a licensed person or making use of for a secured card. These are glorious methods to construct credit if you happen to’re beneath 18, as you are too younger to use for a card however can set your self up for future success.

Related: Quick Points: Have good credit? Share it with a licensed person

Low revenue or unemployment

Credit card issuers do not publish minimal revenue necessities for his or her credit playing cards, however if you happen to should not have enough revenue (or any in any respect), you could possibly danger being denied. This is as a result of the credit card firm cannot belief that you’ve got the power to repay all of the money owed you cost to the card.

Remember, you by no means need to lie about your revenue on a credit card application; doing so can jeopardize your application. An issuer could request that you simply submit a tax return or pay stubs to confirm your revenue. If you are unable to show that you simply earn what you claimed, you could even be blacklisted by that issuer.

That means you will not be accepted for any new playing cards from the issuer, and your present accounts could also be shut down.

Related: Chosen for an American Express monetary evaluate? Here’s what to anticipate

Missed funds

Having a poor fee historical past means you could not be capable to repay an excellent stability, which might drop your credit rating significantly. Depending on the fee, it will probably probably keep on your credit report for as much as seven years. If you can’t make a fee or have credit card debt, think about making use of for a stability switch credit card to assist handle your debt.

Related: How to avoid wasting your credit rating after a late fee

Credit utilization is just too excessive

Carrying a stability from month to month signifies that you could be not be capable to pay your stability in full and could also be liable to defaulting. If your excellent balances are too excessive, issuers could also be hesitant to approve you.

Keeping your credit utilization fee beneath 30% is finest for your credit rating as a result of it exhibits you are managing your credit playing cards nicely and avoiding overspending.

If you utilize greater than 35% of your credit restrict, think about requesting a rise from the issuer. Just know that in some instances, this can lead to a tough inquiry on your credit report, however most instances, it is a gentle pull. Before requesting a credit line improve over the cellphone or on-line, you can be knowledgeable if it is a laborious inquiry.

Related: Credit utilization ratio: What it’s and the way it impacts your credit rating

Too many latest credit inquiries

Having too many inquiries on your credit report inside a brief time frame can lead to a credit card application denial. An issuer could view somebody with many inquires in a brief span of time as a dangerous borrower who’s in want of cash and maybe unable to repay debt responsibly.

There are two sorts of credit inquiries: a tough inquiry and a gentle inquiry.

A tough inquiry (often known as a tough pull) signifies that a lender evaluations your credit report to find out your creditworthiness for issues like a credit card, auto mortgage or mortgage. It will often have an effect on your rating.

A gentle inquiry (often known as a gentle pull) happens whenever you examine your personal credit report or a creditor checks your credit report back to gauge how nicely you handle your credit. Soft inquiries do not have an effect on your credit rating, however they’re listed on your credit report.

There is not any set variety of inquiries that’s thought-about too many, however we advise minimizing your inquiries earlier than making use of for a brand new credit card to lift your odds of approval.

You have account defaults

Account defaults lead to main repercussions. Defaults point out that you have not paid your excellent debt, which is able to restrict you from acquiring new credit.

Some examples of defaults are chapter, repossession, foreclosures and charge-offs. They might be seen on your credit report for as much as seven years.

Newly opened accounts

Opening too many credit accounts inside a brief interval is usually a pink flag. If you will have opened a brand new credit card inside the previous a number of months, the credit card issuer could must see extra historical past with your new card earlier than deciding whether or not to grant extra credit or not.

Waiting six months between credit card functions is mostly really helpful. Six months is sufficient time to show a sample of creditworthiness. If six months is just too lengthy, we advocate ready three months on the naked minimal. Anything lower than that, and you will doubtless face rejection.

Some issuers even have stricter necessities for his or her credit playing cards. For instance, Chase’s notorious 5/24 rule states that an applicant will doubtless be denied for a card in the event that they’ve opened 5 or extra playing cards inside the previous 24 months.

Related: The final information to credit card application restrictions

How to get accepted for your subsequent credit card

There are some ways to construct credit to enhance your probabilities of approval.

Build your credit with Experian Boost

Experian Boost is a good way to construct your credit. This characteristic makes use of your financial institution data to seek out on-time funds for month-to-month payments which can be usually not reported on your credit report. For instance, reporting on-time utility, hire and streaming service funds helps enhance your FICO rating.

Become a licensed person

Becoming a licensed person is a good device for these constructing their credit from scratch, particularly if the first cardholder has an extended historical past of on-time funds. In some instances, it will probably additionally assist you restore your credit because of chapter or a number of missed funds. Sometimes, the one requirement is that licensed customers have to be of a sure minimal age.

Get a starter credit card

Consider making use of for a secured credit card to determine or construct your credit. A secured credit card is a good choice if you happen to’re constructing or repairing credit or if you happen to’re having bother getting accepted for a rewards card. Alternatively, you may go for a newbie rewards card with a decrease bar for approval.

- If you need a greater line of credit inside the first yr: Consider the Capital One Platinum Secured Credit Card. It has no annual charge and the potential to obtain a credit line improve after six months. Upon opening any secured card, you may must pay a money deposit that can decide your credit restrict.

- If you like Capital One: The Capital One Savor Cash Rewards Credit Card earns 8% money again on Capital One Entertainment purchases, 5% money again on motels and rental vehicles booked via Capital One Travel and three% money again on eating, leisure, widespread streaming providers and grocery shops (excluding superstores like Target and Walmart).

- If you like Chase: The Chase Freedom Unlimited® (see charges and costs) has spectacular incomes charges: 5% money again on Chase Travel℠ purchases, 3% money again on eating and drugstore purchases and 1.5% money again on all different purchases. This card will pair nicely sooner or later with the Chase Sapphire Preferred® Card (see charges and costs), a extra travel-oriented card that requires a better credit rating and established credit historical past.

Related: The energy of the Chase Trifecta: Maximize your earnings with 3 playing cards

Bottom line

It could be disappointing to be denied for a credit card, however you may strive once more. Federal tips require issuers to offer discover of approval or denial inside 30 days of submission of an application. So, earlier than something, maintain a lookout for a letter or e-mail detailing the issuer’s determination.

If you are rejected, be affected person and repair the issue earlier than making use of for an additional card.

If you occur to disagree with the issuer’s determination, you could name its reconsideration cellphone line.

Related: How to use for a credit card