One of the perfect perks of the Marriott Bonvoy household of credit playing cards is the complimentary elite night time credit you obtain annually — starting from 15 to 25 nights, relying on which card you have. And if you maintain each a personal and a business credit card, you earn as much as 40 elite night time credit yearly out of your playing cards alone.

That’s fairly the top begin for elite standing annually. Let’s focus on the worth you get when you maintain each a personal and small-business Marriott card.

Get 80% of the best way to Platinum standing and alternative advantages

Since you can stack elite night time credit, holding a personal and business Marriott card is worth it if you’re eligible. Some Marriott credit playing cards include 15 elite nights yearly — together with the Marriott Bonvoy Boundless® Credit Card (see charges and charges). However, the Marriott Bonvoy Brilliant® American Express® Card presents 25 elite night time credit per yr.

You could surprise why that is related when a number of of the Marriott playing cards and The Platinum Card® from American Express additionally supply Gold Elite standing (enrollment is required, phrases apply) or the flexibility to earn larger standing based mostly on spending. The large distinction is that this automated standing would not grant you the corresponding variety of elite nights — so you nonetheless need to achieve the conventional qualification thresholds if you need to get pleasure from this system’s Choice Benefits or hit even larger standing tiers.

Related: The full information to incomes Marriott elite standing with credit playing cards

If you regularly keep at Marriott properties, you can stack these 15 to 25 elite night time credit on high of your individual journey to improve to the following elite tier sooner.

When you stack credit between a business card and a personal card that comes with 15 elite night time credit — just like the Marriott Bonvoy Boundless and the Marriott Bonvoy Business® American Express® Card — you’ll have 30 elite night time credit at the start of every yr. Reaching Platinum Elite standing requires 50 nights per yr, that means you’re already 60% of the best way there. You would need to remain simply 20 extra nights (or earn the nights by way of credit card spending on the Boundless card) to achieve the following tier.

And as soon as you’ve reached Platinum Elite standing, the advantages might be extremely precious — together with issues like lounge entry and Nightly Upgrade Awards.

Those with the Marriott Bonvoy Brilliant Amex obtain complimentary Platinum Elite standing annually as a perk of the card. This will entitle you to advantages like room upgrades and complimentary breakfast. However, you is not going to have the mandatory credit (50 nights) to earn the annual alternative profit related to Platinum standing. This profit permits you to select from one of many following:

Daily Newsletter

Reward your inbox with the TPG Daily publication

Join over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

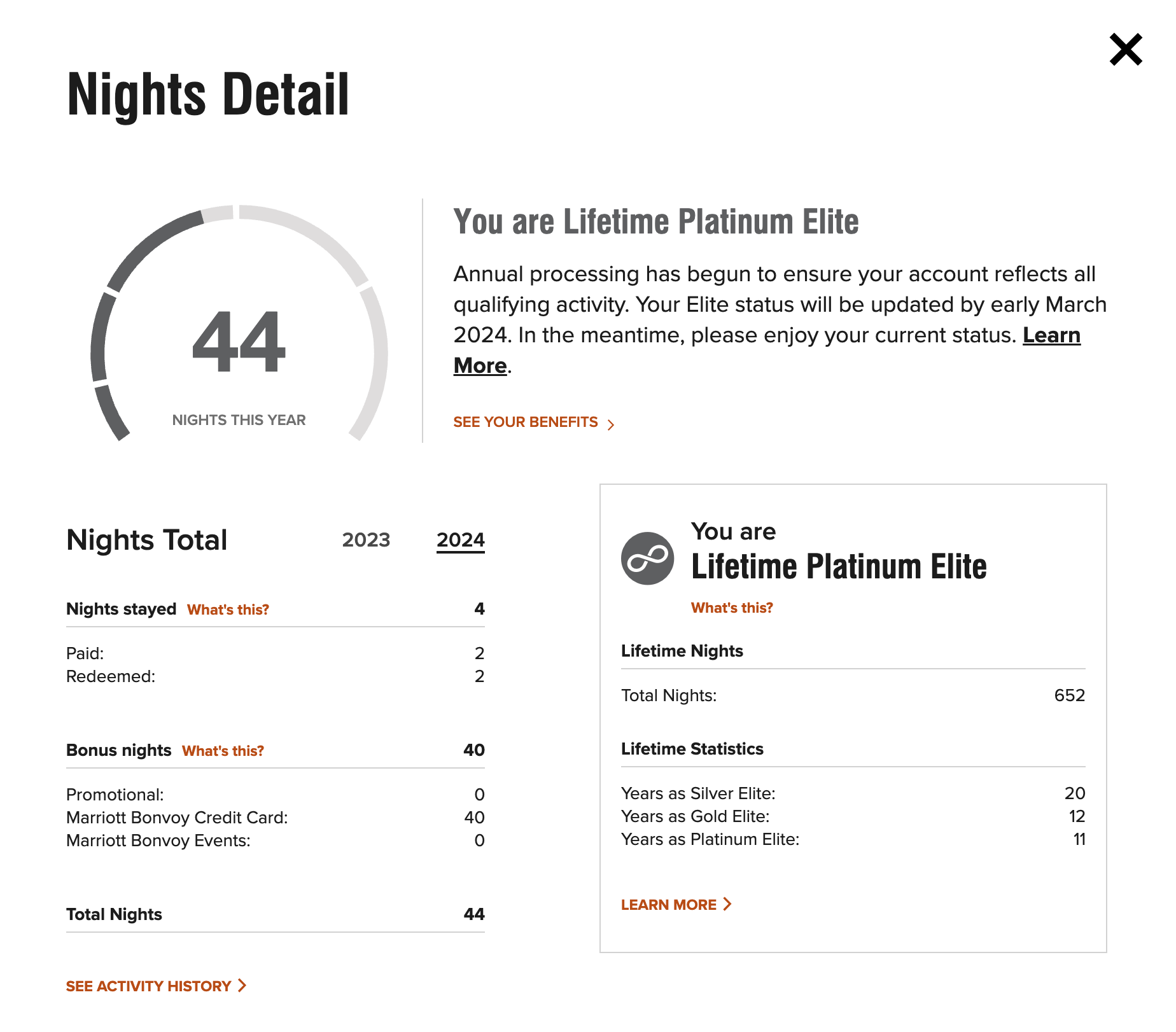

That mentioned, the 25 elite night time credit you earn on the Bonvoy Brilliant might be stacked with the 15 elite nights you’ll get with the Bonvoy Business card, permitting you to begin annually with 40 elite night time credit. TPG senior editorial director Nick Ewen utilized this selection and had solely stayed 4 nights at Marriott properties in 2024.

That’s 80% of what you need to earn your first Choice Benefit choice (at 50 nights) and greater than midway to the 75 nights required for Titanium Elite standing. Reaching Titanium unlocks one other Choice Benefit together with added perks like the flexibility to be upgraded to straightforward suites at Ritz-Carlton properties.

Annual award nights

But why cease at two Marriott playing cards?

There are a number of causes to have as many Marriott credit playing cards as you can get your arms on. This is due to the unimaginable worth you can get from the anniversary award night time certificates. Both the Bonvoy Boundless and Bonvoy Business playing cards supply an anniversary reward night time price as much as 35,000 factors. However, the premium Marriott Bonvoy Brilliant — with its $650 annual price (see charges and charges) — presents an annual award night time price as much as 85,000 factors per night time. Certain accommodations have resort charges.

Based on TPG’s April 2025 valuations, Marriott factors are price 0.7 cents every, that means 35,000 factors are price $245.

Still, relying on how you journey, you would possibly have the ability to get an excellent larger return on these award nights. A former TPG staffer used theirs on the Sheraton Grand Hyde Park in Sydney, the place they had been upgraded to a huge terrace suite throughout peak journey season, and at The St. Regis Beijing for a room that will have price properly over $300 per night time.

With Marriott’s dynamic pricing, the flexibility to make use of these awards is much less predictable than prior to now. However, it is nonetheless doable to redeem these awards for greater than the price of your credit card’s annual price, that means this one profit alone can justify holding your Marriott credit playing cards yr after yr.

There are two exceptions right here. The Marriott Bonvoy Bevy™ American Express® Card and Marriott Bonvoy Bountiful Card don’t supply free night time awards mechanically annually. On each playing cards, you would need to make $15,000 in purchases annually to obtain a free night time award price as much as 50,000 factors. Note that sure accommodations have obligatory resort prices.

The info for the Marriott Bonvoy Bountiful Card has been collected independently by The Points Guy. The card particulars on this web page haven’t been reviewed or supplied by the card issuer.

Spending class bonuses

Aside from annual award nights and elite night time credit, having a personal and business Marriott card can assist you earn extra factors throughout a number of spending classes. All 4 Marriott playing cards earn 2 factors per greenback spent on on a regular basis spending and 6 factors per greenback spent at accommodations taking part within the Marriott Bonvoy program (except the no-annual-fee Marriott Bonvoy Bold® Credit Card (see charges and charges); see particulars beneath.

Related: Which Marriott Bonvoy credit card is true for you?

But it is the opposite bonus classes, most of which don’t overlap, that may assist you maximize your earnings:

- Marriott Bonvoy Bevy American Express Card: Earn 4 factors per greenback spent on the primary $15,000 of mixed purchases at eating places worldwide and U.S. supermarkets every calendar yr (then 2 factors per greenback after that). The Bonvoy Bevy Amex options an annual price of $250 (see charges and charges).

- Marriott Bonvoy Bold Credit Card: Earn 2 factors per greenback spent at grocery shops, ride-hailing companies, choose meals supply, choose streaming, web, cable and cellphone companies and 1 level per greenback spent on all different purchases.

- Marriott Bonvoy Boundless Credit Card: Earn 3 factors per greenback spent on the primary $6,000 spent in mixed purchases annually at gasoline stations, grocery shops and eating (then 2 factors per greenback spent after that).

- Marriott Bonvoy Bountiful Card: Earn 4 factors per greenback spent on the primary $15,000 in mixed purchases on grocery shops and eating annually (then 2 factors per greenback spent after that).

- Marriott Bonvoy Brilliant American Express Card: Earn 3 factors per greenback spent on eating at eating places worldwide and on flights booked instantly with airways. The Bonvoy Brilliant Amex options a $650 annual price (see charges and charges).

- Marriott Bonvoy Business American Express Card: Earn 4 factors per greenback spent on purchases at eating places worldwide, U.S. gasoline stations, wi-fi phone companies bought instantly from U.S. service suppliers and U.S. transport purchases. The Bonvoy Business Amex options an annual price of $125 (see charges and charges).

So, if you’re a large Marriott fan and need to focus your incomes technique solely on Bonvoy factors, you can have a number of playing cards and get pleasure from incomes charges throughout a number of classes.

Related: Are you eligible for a new Marriott Bonvoy card? This chart tells you sure or no

Bottom line

Marriott has made it a lot simpler to qualify for elite standing by permitting prospects with each personal and business credit playing cards to earn two units of elite night time credit annually. In reality, many TPG staffers kicked off 2024 with 40 elite night time credit. When you add this to the annual award night time certificates on these credit playing cards, it is virtually a no-brainer to carry each a personal and business card in your pockets.

Apply right here: Marriott Bonvoy Bevy American Express Card

Apply right here: Marriott Bonvoy Bold Credit Card

Apply right here: Marriott Bonvoy Boundless Credit Card

Apply right here: Marriott Bonvoy Brilliant American Express Card

Apply right here: Marriott Bonvoy Business American Express Card

For charges and charges of the Marriott Bonvoy Brilliant Amex, click on right here.

For charges and charges of the Marriott Bonvoy Bevy Amex, click on right here.

For charges and charges of the Marriott Bonvoy Business Amex, click on right here.